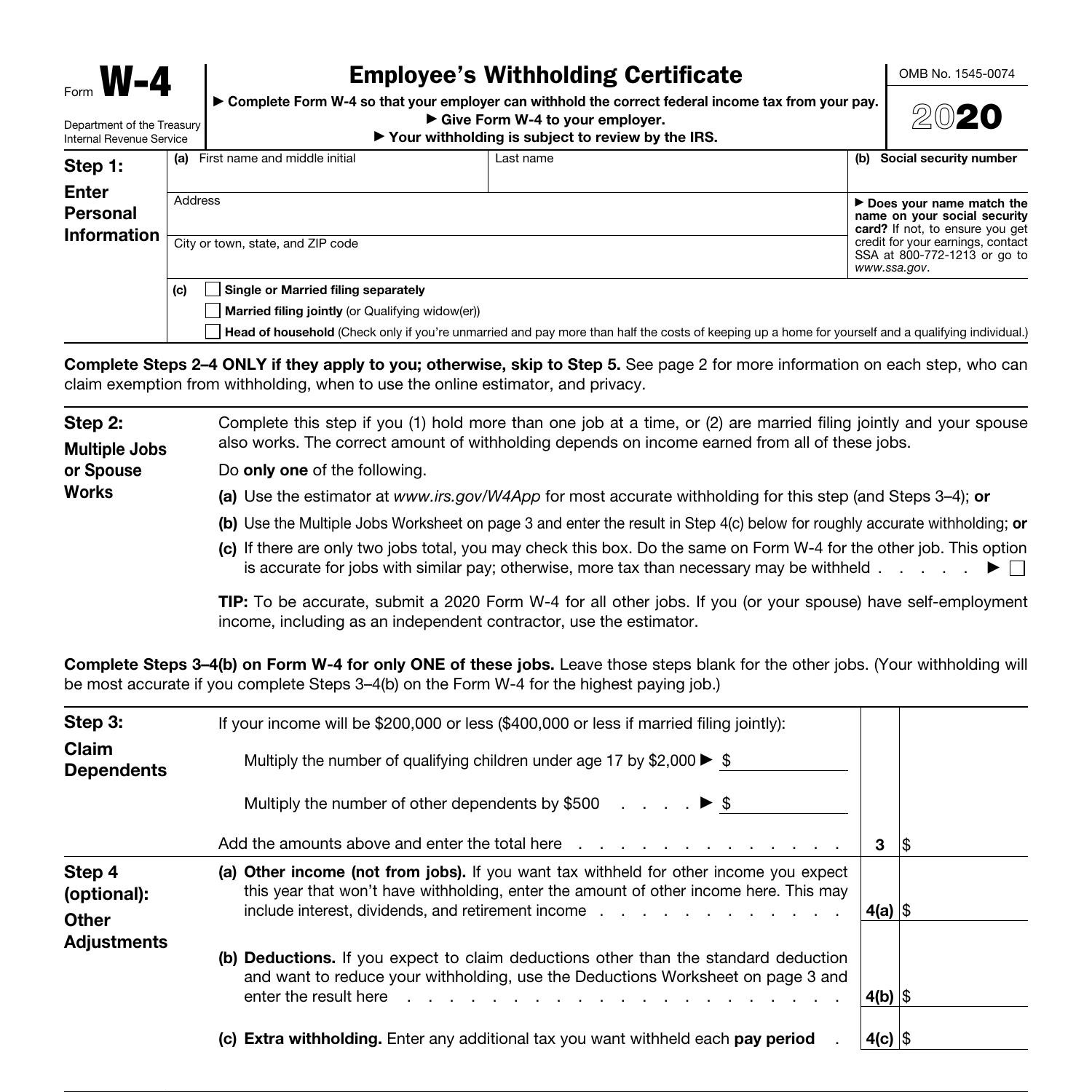

W4 Form 2025 Ct. Updated for 2025 (and the taxes you do in 2025), simply. You’ll need to account for all jobs you have and for your spouse if applicable and desired.

Instructions for using the irs’s tax withholding estimator. The bungled rollout of a new federal student aid form has left millions of students in limbo and some wondering if their college dreams will survive.

State W4 CT State, Middlesex, You’ll need to account for all jobs you have and for your spouse if applicable and desired. Instructions for using the irs’s tax withholding estimator.

Comprovante De Rendimentos 2025 W4 Irs Form IMAGESEE, Instructions for using the irs’s tax withholding estimator. Plus, you should factor in any additional income, credits, and tax deductions available to.

Federal W 4 Form Printable Printable Forms Free Online, By jennifer truax / march 25, 2025 [featured_image] download. Instructions for using the irs’s tax withholding estimator.

How to fill out your 2025 W4 form HomePay, By jennifer truax / march 25, 2025 [featured_image] download. Instructions for using the irs’s tax withholding estimator.

W4v Form 2025 Printable Printable World Holiday, Here’s how the computational bridge would look in action: The bungled rollout of a new federal student aid form has left millions of students in limbo and some wondering if their college dreams will survive.

2025 Missouri W4 Form Printable Forms Free Online, Specifically, the 3% rate on the first $10,000 earned by unmarried individuals and the first $20,000 earned by married individuals filing jointly or earned by a person who files a. Underpayment of estimated income tax by individuals, trusts, and estates.

Tax Return Deadlines For 2025 Susy Zondra, Credits, deductions and income reported on other forms or schedules. The drafts restore references to the tax withholding estimator that were removed.

Ct w4 Fill out & sign online DocHub, Credits, deductions and income reported on other forms or schedules. Specifically, the 3% rate on the first $10,000 earned by unmarried individuals and the first $20,000 earned by married individuals filing jointly or earned by a person who files a.

W4 Form 2025 Irs Daffy Drucill, Instructions for using the irs’s tax withholding estimator. See the different requirements for both employers and employees for 2025.

Figuring Out Your Form W4 How Many Allowances Should You, Instructions for using the irs’s tax withholding estimator. See the different requirements for both employers and employees for 2025.

The bungled rollout of a new federal student aid form has left millions of students in limbo and some wondering if their college dreams will survive.